Now Reading: Crypto Compliance Insights: Navigating the Evolving Landscape of Blockchain Regulation and Cryptocurrency Laws

-

01

Crypto Compliance Insights: Navigating the Evolving Landscape of Blockchain Regulation and Cryptocurrency Laws

Crypto Compliance Insights: Navigating the Evolving Landscape of Blockchain Regulation and Cryptocurrency Laws

Keyword: Crypto Compliance

Introduction

This article aims to provide comprehensive insights into the current state of crypto compliance, exploring the intricate web of laws surrounding blockchain technology and digital assets. In the ever-evolving world of blockchain and cryptocurrencies, staying abreast of the latest regulatory developments is crucial for businesses and individuals alike.

1. Understanding Blockchain Regulation

Blockchain, the underlying technology behind cryptocurrencies, has garnered global attention for its decentralized and transparent nature. However, this very nature poses challenges for regulators seeking to maintain control and prevent illicit activities. As governments worldwide grapple with defining the legal framework for blockchain, understanding the nuances of these regulations becomes imperative.

2. Regulatory Approaches

Different countries adopt diverse approaches to blockchain regulation. Some embrace the technology, fostering innovation, while others take a cautious stance, prioritizing consumer protection and national security. Understanding these diverse regulatory approaches is vital for businesses operating in the global crypto landscape.

3. The Cryptocurrency Regulatory Landscape

Cryptocurrency laws vary widely, reflecting the global diversity in regulatory philosophies. From outright bans to comprehensive frameworks, governments are developing strategies to address the challenges and opportunities presented by cryptocurrencies.

4. Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

AML and KYC regulations form the backbone of cryptocurrency compliance efforts. Governments are tightening the screws on crypto exchanges and businesses to ensure robust identity verification processes, preventing money laundering, and other illicit activities.

5. Taxation Policies

Taxation of cryptocurrencies remains a contentious issue. Exploring the diverse taxation policies across different jurisdictions is essential for individuals and businesses engaged in crypto transactions. The lack of a standardized approach adds complexity to Crypto Compliance efforts, necessitating a nuanced understanding of local tax laws.

6. Securities Laws and Token Offerings

The classification of cryptocurrencies as securities or commodities significantly impacts their regulatory treatment. Understanding the evolving standards for Initial Coin Offerings (ICOs) and Security Token Offerings (STOs) is crucial for businesses seeking to raise funds through token sales.

7. Regulatory Developments Across Regions

To navigate the complex web of blockchain regulation and cryptocurrency laws and Crypto Compliance, it’s essential to delve into the regulatory developments in key regions.

a. North America

In North America, the regulatory landscape for cryptocurrencies is multifaceted. The United States, with its patchwork of federal and state regulations, poses unique challenges. Canada, on the other hand, adopts a more accommodating approach, fostering innovation while ensuring consumer protection.

b. Europe

Europe has emerged as a hub for crypto innovation. However, the regulatory environment varies widely among European countries. Understanding the European Union’s overarching policies and individual country regulations is crucial for businesses operating in this region.

c. Asia-Pacific

The Asia-Pacific region showcases a diverse range of regulatory approaches. From the crypto-friendly environment in Japan to regulatory uncertainties in some Southeast Asian countries, businesses must navigate a complex landscape to ensure compliance.

8. Compliance Challenges and Solutions

As the crypto industry matures, Crypto Compliance challenges continue to evolve. From technological advancements to changing regulatory landscapes, businesses must stay proactive in addressing these challenges.

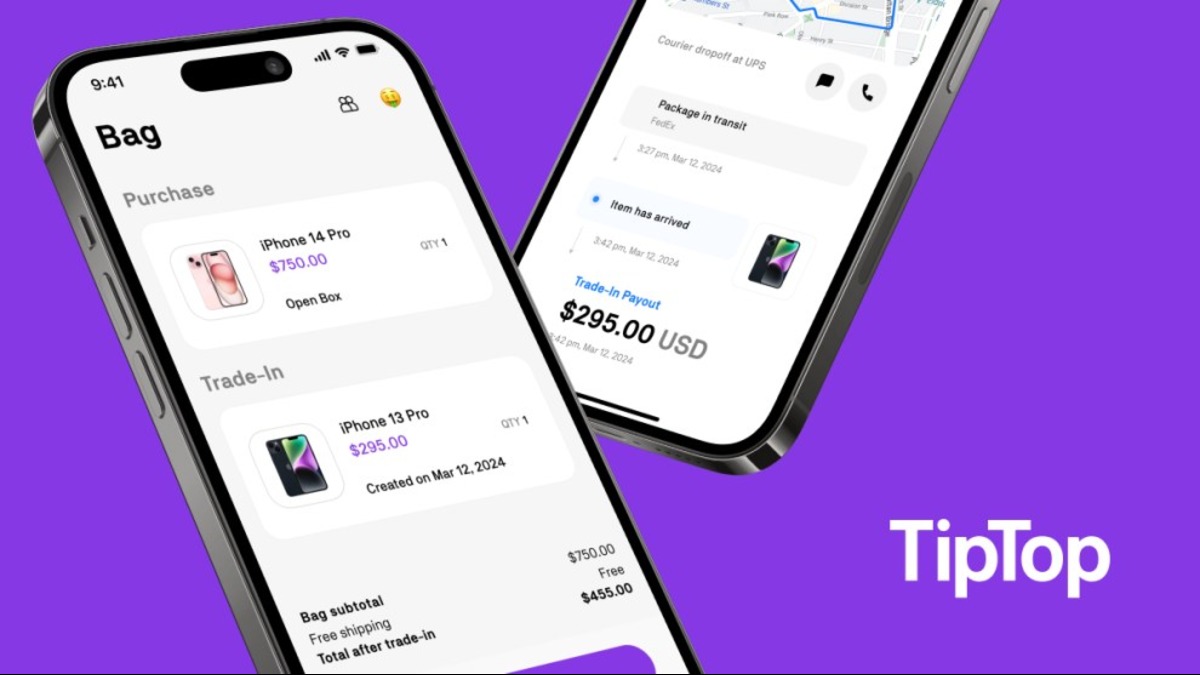

9. Technological Advancements and DeFi

Decentralized Finance (DeFi) is reshaping the financial landscape, presenting both opportunities and challenges. Regulators are grappling with the decentralized nature of DeFi platforms, necessitating a dynamic approach to compliance.

10. Global Regulatory Coordination

The lack of global consensus on crypto regulation complicates Crypto Compliance efforts for businesses operating across borders. Advocating for international cooperation and standardization is crucial for fostering a more predictable regulatory environment.

Conclusion

In the dynamic world of crypto compliance, staying informed and proactive is the key to navigating the ever-changing regulatory landscape. By understanding the nuances of blockchain regulation, cryptocurrency laws, and regional developments, businesses and individuals can position themselves for success while ensuring adherence to legal requirements. As the crypto industry continues to evolve, so too will the regulatory frameworks, making ongoing education and adaptability essential for sustained success in this exciting and challenging space.

Also Read: Silicon States: America’s Tech Hub Evolution Unveiling the Growth of Tech Centres